|

|

Third Quarter Results: Biotage, Bio-Techne, HORIBA and Shimadzu

Biotage Reports Strong Sales in China and the Europe & EMEA Region

|

Biotage报告在中国以及欧洲和欧洲、中东和非洲地区的销售强劲

|

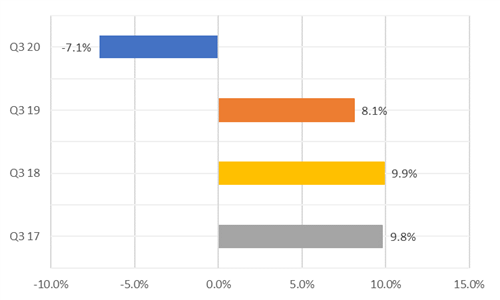

Biotage by Product Line Q3 FY20

|

Biotage concluded the third quarter with revenues declining in the high single digits. Organic sales fell 7.1% to SEK 262.6 million ($29.6 million at SEK 8.87 = $1) (see IBO 9/1/20). On a reported basis, systems and aftermarket product sales accounted for 51% and 49% of revenues, respectively.

|

Biotage在第三季度结束时,收入以个位数的最高水平下降。有机产品销售额下降7.1%,至2.626亿瑞典克朗(2,960万美元,8.87瑞典克朗=1美元)(见IBO 9/1/20)。根据报告,系统和售后市场产品的销售分别占收入的51%和49%。

|

Biotage Operating Profit Q3 FY20

|

Despite reported and organic sales declines for the third quarter, Biotage experienced a 3.3% rise in sales sequentially. The company attributed its third quarter financial performance to cost control and its products meeting demand in COVID-19 vaccine and therapeutic development. However, Biotage still weathered COVID-19-related headwinds, such as business disruptions stemming from global lockdown measures. Additionally, Biotage saw stable demand in the precision medicine market and for non-COVID-19-related product lines.

|

尽管有报告称第三季度的销售额出现了有机下降,但Biotage的销售额连续增长了3.3%。该公司将其第三季度的财务业绩归因于成本控制及其产品满足 COVID-19 疫苗和治疗药物开发的需求。但是,Biotage仍然经受住了与COVID-19相关的不利因素,例如全球封锁措施导致的业务中断。此外,Biotage在精准医疗市场和非COVID-19相关产品线的需求稳定。

|

Biotage by Region Q3 FY20

|

On a geographical basis, Biotage reported significant sales growth in Europe & EMEA and specific regions within Asia, especially China. Indeed, the greatest revenue growth for the company came from China. However, China's strong performance could not offset tepid sales in India and Japan due to both regions experiencing business disruptions because of COVID-19.

|

就地域而言,Biotage报告称,欧洲和欧洲、中东和非洲以及亚洲特定地区(尤其是中国)的销售额显著增长。事实上,该公司收入增长最大的来自中国。但是,中国的强劲表现无法抵消印度和日本的销售疲软,因为这两个地区都因 COVID-19 而经历了业务中断。

|

|

Europe & EMEA was the only region besides China to report sales growth for Biotage thanks to end-users resuming activities in the area. However, the company noted that sales recovery in Europe & EMEA was proceeding at a slow pace.

|

欧洲和欧洲、中东和非洲地区是除中国以外唯一报告Biotage销售增长的地区,这要归功于最终用户恢复在该地区的活动。但是,该公司指出,欧洲和欧洲、中东和非洲地区的销售复苏进展缓慢。

|

Biotage by Division Q3 FY20

|

By division, the Organic Chemistry business performed the best due to robust sales for its instrument portfolio in China. In contrast, Biotage's Scale-Up division was the worst performer due to tepid demand from the cannabis market, especially in the Americas.

|

按部门划分,有机化学业务表现最好,原因是其在中国的仪器产品组合销售强劲。相比之下,由于大麻市场(尤其是美洲)的需求不大,Biotage的Scale-Up部门表现最差。

|

|

Biotage did not provide revenue guidance for the fourth quarter or full year. However, the company provided commentary for the remainder of 2020, stating it was in good financial standings to weather any external challenges yet still considered pandemic-related challenges. For example, the company anticipates a longer wait in receiving payment from customers whose own financial position could be impacted by the pandemic. Lastly, Biotage reaffirmed its forecast of an average annual organic sales growth goal of 8% over three years (see IBO 9/11/20).

|

Biotage没有提供第四季度或全年的收入指导。但是,该公司提供了2020年剩余时间的评论,表示其财务状况良好,可以应对任何外部挑战,但仍被视为与疫情相关的挑战。例如,该公司预计等待更长的时间才能收到自身财务状况可能受到疫情影响的客户的付款。最后,Biotage重申了其预测,即三年内平均每年有机销售增长目标为8%(见IBO 9/11/20)。

|

Bio-Techne Starts Fiscal 2021 with Strong Sales Growth

|

Bio-Techne 在 2021 财年开始时销售增长强劲

|

Bio-Techne by Division Q1 FY21

|

Bio-Teche's fiscal first quarter revenue performance (see IBO 8/17/20) reached pre-pandemic levels, posting double-digit growth on both a reported and organic basis. The company's organic sales performance exceeded expectations, which was initially a flat organic sales rate forecast. Bio-Techne attributed its financial performance to laboratory customers reopening worksites and resuming paused projects due to COVID-19 lockdown measures. The company's revenue was driven by an increase in demand from both the biopharmaceutical and academic end-markets after a tepid response in the fiscal fourth quarter. Lastly, Bio-Techne's COVID-19-related research product sales contributed three-percentage points to total revenues.

|

Bio-Teche第一财年第一季度的收入表现(见IBO 8/17/20)达到了疫情前的水平,在报告和有机基础上均实现了两位数的增长。该公司的有机销售业绩超出了预期,这最初是持平的有机销售率预测。由于 COVID-19 封锁措施,Bio-Techne 将其财务表现归因于实验室客户重新开放工作场所和恢复暂停的项目。在第四财年的反应不温之后,生物制药和学术终端市场的需求增加,推动了该公司的收入。最后,Bio-Techne与COVID-19相关的研究产品销售额为总收入贡献了三个百分点。

|

Bio-Techne Operating Margin by Division Q1 FY21

|

Protein Sciences business revenues were driven by strong sales of its Simple Western and Simple Plex products, posting about 35% and 75% growth, respectively. Additionally, Protein Sciences' reagents portfolio sales improved sequentially but posted a flat sales rate on a year-over-year basis. End-market wise, reagents portfolio sales were robust in the biopharmaceutical end-market yet were moderate in the academic laboratory sector due to the slow reopening of laboratories.

|

蛋白质科学的业务收入受到其 Simple Western 和 Simple Plex 产品的强劲销售的推动,分别增长了约 35% 和 75%。此外,Protein Sciences的试剂组合销售额连续改善,但销售率同比持平。在终端市场方面,生物制药终端市场的试剂组合销售强劲,但由于实验室重新开放缓慢,学术实验室领域的试剂组合销售不大。

|

|

The Diagnostics and Genomics division was also a strong performer, posting double-digit organic and reported sales growth. Genomics segment revenue grew approximately 30% thanks to robust sales in the RNA Scope product line and 60% revenue growth in the pharmaceutical assays service business. Within the Diagnostics division, the Exosome Diagnostics portfolio experienced a 125% sales uptick thanks in part to a surge in volume of ExoDx testing, which was close to pre-COVID-19 pandemic levels.

|

诊断和基因组学部门也表现强劲,实现了两位数的自然增长,并报告了销售增长。得益于RNA Scope产品线的强劲销售以及药物测定服务业务的收入增长60%,基因组学部门的收入增长了约30%。在诊断部门,Exosome Diagnostics产品组合的销售额增长了125%,这在一定程度上要归功于ExodX测试量的激增,接近疫情爆发前的水平。

|

Bio-Techne by Region Q1 FY21

|

On a geographical basis, the US and Europe posted approximately 10% organic revenue growth because of stable demand from both the biopharmaceutical and academic end-markets. Specifically, both regions grew revenues in the high-teens in the biopharmaceutical end-market while also seeing a sales recovery in the academic sector resulting in mid-single-digit revenue growth.

|

就地域而言,由于生物制药和学术终端市场的需求稳定,美国和欧洲的收入有机增长约为10%。具体来说,这两个地区的生物制药终端市场收入都在十几岁时增长,同时学术部门的销售也有所恢复,从而实现了中等个位数的收入增长。

|

|

Sales in China grew in the high teens despite an uptick in coronavirus infection rates at the beginning of the quarter. Specifically, early in the quarter, Chinese sales suffered from laboratories closing due to social distancing restrictions.

|

尽管本季度初冠状病毒感染率有所上升,但中国的销售额仍在十几岁时增长。具体来说,在本季度初,由于社交距离限制,实验室关闭,中国的销售受到影响。

|

|

Lastly, Asia's revenues increased in the high single digits, with most countries posting significant sales growth. However, pandemic-related shutdowns in India and Australia partially impacted sales for the region.

|

最后,亚洲的收入以个位数的高位数增长,大多数国家的销售额都有显著增长。但是,印度和澳大利亚与疫情相关的停工部分影响了该地区的销售。

|

|

Bio-Techne did not provide a forecast for the fiscal second quarter but did for fiscal 2021. The company predicted that annual sales would experience a double-digit revenue increase and expect this sales rate to continue in subsequent years.

|

Bio-Techne没有提供第二财年的预测,但提供了2021财年的预测。该公司预测,年销售额将实现两位数的收入增长,并预计这一销售率将在未来几年继续保持下去。

|

HORIBA Posts Sequential Sales Growth

|

HORIBA公布连续销售增长

|

|

In the first nine months of 2020, the COVID-19 pandemic continued to disrupt HORIBA's business operations for its Scientific Instruments & Systems (SI) and Process & Environmental Instruments and Systems (P&E) divisions. Despite these challenges, the company's combined sales for SI and P&E rose 2.3% in the third quarter to ¥11,090 million ($104.5 million at ¥106.16 = $1) and made up 24% of the total company sales (see IBO 10/15/20). Please note the charts' financial information is on a quarterly basis sourced from both HORIBA and IBO's calculations. Additionally, the information below stems from both HORIBA's third quarter and nine-month financial data.

|

2020年前九个月,COVID-19 疫情继续扰乱HORIBA科学仪器与系统(SI)和过程与环境仪器与系统(P&E)部门的业务运营。尽管面临这些挑战,该公司第三季度SI和P&E的合并销售额增长了2.3%,至11.90亿日元(1.045亿美元,106.16日元=1美元),占公司总销售额的24%(见IBO 10/15/20)。请注意,图表的财务信息每季度来自HORIBA和IBO的计算。此外,以下信息来自HORIBA第三季度和九个月的财务数据。

|

HORIBA by Division Q3 FY20

|

P&E's nine-month sales benefitted from public utility end-users' continuing projects, yet the business saw a slow investment rate from these customers in that same period. As a result, P&E's nine-month revenues fell 7.7% to ¥12,799 million ($120.6 million). P&E quarterly operating income decreased 21.8% to ¥323 million ($3.0 million), while its nine-month operating income fell 21.8% to ¥763 million ($7.2 million).

|

宝洁九个月的销售受益于公用事业最终用户的持续项目,但同期这些客户的投资速度放缓。结果,宝洁九个月的收入下降了7.7%,至127.99亿日元(1.206亿美元)。宝洁季度营业收入下降21.8%,至3.23亿日元(300万美元),而其九个月营业收入下降21.8%,至7.63亿日元(720万美元)。

|

|

Thanks to a sequential increase in quarterly revenue, P&E raised its fourth quarter and annual revenue forecasts. For the fourth quarter, the business anticipates sales of ¥5,200 million ($49.0 million), which would result in a 7.6% decline. For its annual guidance, P&E expects revenues to increase from ¥17,500 million ($164.8 million) to ¥18,000 million ($169.6 million), leading to a 7.7% decrease (see IBO 10/15/20). Additionally, the division reaffirmed the continuation of low oil industry demand due to customers' poor capital investment in equipment and falling global oil prices (see IBO 10/15/20).

|

得益于季度收入的连续增长,宝洁提高了第四季度和年度收入预测。该公司预计第四季度的销售额为52亿日元(合4,900万美元),这将导致7.6%的下降。根据其年度指引,P&E预计收入将从175亿日元(1.648亿美元)增至18亿日元(1.696亿美元),导致收入下降7.7%(见IBO 10/15/20)。此外,该部门重申,由于客户对设备的资本投资不足以及全球油价下跌,石油行业需求持续低迷(见IBO 10/15/20)。

|

|

SI's quarterly revenue experienced a double-digit increase and posted an operating gain of ¥688 million ($6.5 million), which was an improvement from the operating loss of ¥167 million ($1.6 million). In contrast, SI's first nine-month revenue performance decreased by 2.6% to ¥18,332 ($172.7 million). The business attributed its sales performance to slow R&D activity in various industries, offsetting strong sales of its semiconductor-related measurement products, and high market demand from the pharmaceutical and life science sectors. Additionally, SI posted a nine-month operating income increase of ¥852 million ($8.0 million), which was an improvement from the operating loss of ¥257 million ($2.4 million). SI credited this operating income performance to a reduction in selling expenses.

|

SI的季度收入实现了两位数的增长,营业收益为6.88亿日元(650万美元),较1.67亿日元(160万美元)的营业亏损有所改善。相比之下,SI首九个月的收入业绩下降了2.6%,至18,332日元(1.727亿美元)。该企业将其销售业绩归因于各行各业的研发活动放缓,抵消了半导体相关测量产品的强劲销售以及制药和生命科学领域的高市场需求。此外,SI公布了9个月的营业收入增长8.52亿日元(合800万美元),较2.57亿日元(240万美元)的营业亏损有所改善。SI 将这一营业收入表现归功于销售支出的减少。

|

|

Like P&E, SI's third quarter sales improved sequentially, yet the business reaffirmed its full-year 2020 revenue forecast of ¥26,500 million ($249.6 million), which would be a 2.5% decrease (see IBO 10/15/20). Additionally, SI predicts fourth quarter sales to be ¥8,167 million ($76.9 million), which would result in a 2.1% decline.

|

与P&E一样,SI第三季度的销售额也连续改善,但该公司重申其2020年全年收入预测为265亿日元(2.496亿美元),将下降2.5%(见IBO 10/15/20)。此外,SI预计第四季度的销售额为81.67亿日元(合7,690万美元),这将导致2.1%的下降。

|

HORIBA Q3 FY20 Operating Profit Comparison of Process & Environmental and Scientific Instruments (SI)

Shimadzu Sees Slow Recovery in Academic and Government Markets

|

岛津看到学术和政府市场复苏缓慢

|

|

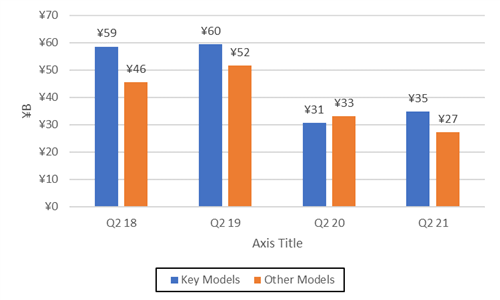

Shimadzu Analytical & Measuring Instrument's (AMI) fiscal second quarter revenues declined 2.6% to ¥62.1 billion ($585 million at ¥106.16 = $1), with local currency growth of 4.0%. Sales accounted for 63% of total company revenues (see IBO 11/16/20). Please note that the charts' financial information is on a quarterly basis sourced from both Shimadzu and IBO's calculations. In contrast, the information in the articles stems from Shimadzu AMI's fiscal first-half 2021 financial data.

|

岛津分析测量仪器(AMI)第二财年收入下降2.6%,至621亿日元(5.85亿美元,106.16日元=1美元),当地货币增长4.0%。销售额占公司总收入的63%(见IBO 11/16/20)。请注意,图表的财务信息每季度来自Shimadzu和IBO的计算。相比之下,文章中的信息来自 Shimadzu AMI 2021 财年上半年的财务数据。

|

Shimadzu AMI by Product Line Q2 FY21

|

For the fiscal second quarter and the first half of 2021, Shimadzu AMI reported a low single-digit revenue decrease. Sales of COVID-19-related PCR diagnostic kits totaled ¥1.1 billion ($10.4 million) in the fiscal first-half of 2021. But Shimadzu AMI sales suffered from closures of automotive and academic worksites due to the COVID-19 pandemic.

|

在第二财年和2021年上半年,Shimadzu AMI公布的收入下降幅度很低,只有个位数。2021年上半年,与新冠肺炎相关的PCR诊断试剂盒的销售总额为11亿日元(合1,040万美元)。但是,由于 COVID-19 疫情,Shimadzu AMI 的销售受到汽车和学术工作场所关闭的影响。

|

Shimadzu AMI Operating Margin Q2 FY21

|

By end-market, fiscal first-half 2021 sales to the three main sectors were mixed. The pharmaceutical/contract analysis/healthcare/food market was the only one that was positive thanks to strong global demand from pharmaceutical and healthcare end-users. Within the pharmaceutical, public health and healthcare sectors, Shimadzu AMI saw significant sales growth for its Key Model and Other Models' portfolios. Regarding the Key Model line, sales of its LC, MS and GC products in the pharmaceutical, healthcare and public health fields were strong, respectively. Other Models sales benefitted from demand from the COVID-19-related marketplace, especially Shimadzu AMI's COVID-19-related PCR diagnostic kits. However, overall Other Models revenue declined for both the fiscal second quarter and first-half 2021 because of a slow recovery of transport equipment and other industrial fields customers resuming capital equipment investment.

|

截至终端市场,2021年上半年三个主要行业的销售额喜忧参半。由于制药和医疗保健最终用户的强劲全球需求,制药/合同分析/医疗保健/食品市场是唯一一个积极的市场。在制药、公共卫生和医疗保健领域,Shimadzu AMI的Key Model和其他模型产品组合的销售额显著增长。关于Key Model系列,其LC、MS和GC产品在制药、医疗保健和公共卫生领域的销售分别强劲。其他型号的销售受益于COVID-19相关市场的需求,尤其是岛津AMI的COVID-19相关PCR诊断试剂盒。但是,由于运输设备和其他工业领域的客户恢复资本设备投资的缓慢复苏,其他车型在2021年第二季度和上半年的总体收入均有所下降。

|

|

On a geographical basis, chemicals/materials/electrical/automotive sales continued to recover in China yet decreased in other regions. Additionally, demand was low from the automotive industry.

|

就地域而言,中国的化学品/材料/电气/汽车销售继续恢复,但其他地区的销售额有所下降。此外,汽车行业的需求也很低。

|

|

The closing of academic institutions and governments suspended bidding for projects, negatively impacting AMI sales to this sector. Though government-related sales performed poorly overall, Shimadzu AMI observed pockets of growth resulting from some government-users resuming funding and bidding.

|

学术机构和政府的关闭暂停了项目的竞标,对AMI在该领域的销售产生了负面影响。尽管与政府相关的销售总体表现不佳,但 Shimadzu AMI 观察到,由于一些政府用户恢复融资和竞标,出现了一些增长。

|

|

In Japan, sales finished down due to waning demand for Shimadzu AMI's testing machines, nondestructive inspection machines, and other products in the country's transport equipment, chemical and electrical industries. Additionally, fiscal first-half 2021 revenues faced a tough comparison due to a sales uptick from last year, which occurred because end-users wanted to buy equipment before Japan increased its consumption tax.

|

在日本,由于运输设备、化学和电气行业对Shimadzu AMI的试验机、无损检测机和其他产品的需求减弱,销售额结束了。此外,由于销售额比去年有所增长,2021年上半年的收入面临艰难的比较,这是因为最终用户希望在日本提高消费税之前购买设备。

|

|

Shimadzu AMI sales in China saw strength due to demand for LC and MS systems from the pharmaceutical and food safety industries. LC and MS system sales were also robust due to the country's investment in fighting the pandemic and preparing to release the 2020 Chinese Pharmacopoeia.

|

由于制药和食品安全行业对液相色谱和质谱系统的需求,Shimadzu AMI在中国的销售强劲。由于该国在抗击疫情和准备发布2020年中国药典方面进行了投资,LC和MS系统的销售也很强劲。

|

|

In Other Asian Countries, overall sales tumbled yet improved on a sequential basis. Sales began to recover after facing challenges stemming from pandemic-related lockdown measures. In India, sales for Shimadzu AMI's LC and MS products improved as the country's pharmaceutical industry resumed domestic drug manufacturing after a slowdown of China imports.

|

在其他亚洲国家,整体销售额下降但连续改善。在面临与疫情相关的封锁措施带来的挑战之后,销售额开始恢复。在印度,Shimadzu AMI的LC和MS产品的销售有所改善,因为在中国进口放缓之后,该国的制药行业恢复了国内药品生产。

|

|

North American sales improved sequentially after a high single-digit decline in the fiscal first quarter, resulting from social distancing restrictions (see IBO 9/15/20). For the fiscal first-half of 2021, regional sales grew thanks to healthcare institutions purchasing MALDI-MS systems to detect and identify microorganisms inside hospitals.

|

由于社交距离的限制,北美的销售额在第一财年创下个位数的高幅下降之后,连续改善(见IBO 9/15/20)。2021年上半年,由于医疗机构购买了用于检测和识别医院内微生物的MALDI-MS系统,该地区的销售额有所增长。

|

|

Within Europe, LC and MS systems' demand rose as Russia's food safety market began to export agricultural and food products to other European countries. In contrast, academic market sales in Europe tumbled because of the temporary closures of universities.

|

在欧洲,随着俄罗斯食品安全市场开始向其他欧洲国家出口农产品和食品,LC和MS系统的需求上升。相比之下,由于大学暂时关闭,欧洲的学术市场销售额下滑。

|

Shimadzu AMI by Region Q2 FY21

|

Shimadzu AMI forecasts the fiscal year 2021 sales decline 8.2% to ¥228.0 billion ($2.1 billion), with local currency growth falling about 3%. On a geographical basis, throughout the year, revenues are predicted to recover in China, while other regions may face pandemic-related challenges.

|

Shimadzu AMI预测,2021财年的销售额将下降8.2%,至2280亿日元(21亿美元),其中当地货币增长下降约3%。从地理角度来看,预计中国全年收入将恢复,而其他地区可能面临与疫情相关的挑战。

|

|

For the latter half of fiscal 2021, Shimadzu AMI forecasts the pandemic will continue to impact its overall business on both a geographical and end-market basis yet expects pockets of sales growth in specific sectors. For example, the company believes the chemicals/materials/electrical/automotive market will face the most challenges due to decreased capital investments and other factors affecting the automotive, steel and chemical materials and machinery industries.

|

Shimadzu AMI预测,在2021年财年的下半年,疫情将继续影响其地域和终端市场的整体业务,但预计特定行业的销售额将出现小幅增长。例如,该公司认为,由于资本投资减少以及影响汽车、钢铁和化工材料和机械行业的其他因素,化学品/材料/电气/汽车市场将面临最大的挑战。

|

|

Thanks to the reopening of academic worksites and governments resuming bidding for projects, the academia/government end-market is expected to fare better. Additionally, because of the pandemic, the company anticipates demand in the government market to increase as countries initiate R&D projects to counter future pandemics.

|

由于学术工作场所的重新开放以及政府恢复对项目的竞标,预计学术界/政府终端市场的表现将有所改善。此外,由于疫情的影响,该公司预计,随着各国启动研发项目以应对未来的疫情,政府市场的需求将增加。

|

|

Lastly, Shimadzu AMI expects pharmaceuticals/contract analysis/healthcare/food sector sales to grow in the latter half of fiscal 2021. For instance, the company sees high demand for its COVID-19-related PCR detection kits outside of Japan. Additionally, in China, the company forecasts sales will increase due to the 2020 Chinese Pharmacopoeia release. Lastly, Shimadzu AMI predicts robust demand in the overall pharmaceutical and virus research markets.

|

最后,Shimadzu AMI预计,药品/合同分析/医疗保健/食品行业的销售额将在2021年下半年增长。例如,该公司认为日本以外地区对与COVID-19相关的PCR检测试剂盒的需求很高。此外,该公司预计,由于2020年《中国药典》的发布,中国的销售额将增加。最后,Shimadzu AMI预测,整个制药和病毒研究市场的需求将强劲。

|

|

*Correction: IBO miscalculated Shimadzu AMI's South American Q1 FY21 revenue in the quarterly write-up (see IBO 9/15/20). The country's quarterly sales tumbled 55.6%, not 95.6%, as previously reported. Please refer to the table below, showing the correction.

|

* 更正:IBO 在季度报告中错误计算了 Shimadzu AMI 在南美 21 财年第一季度的收入(见 IBO 9/15/20)。该国的季度销售额下降了55.6%,而不是之前报告的95.6%。请参考下表,其中显示了更正情况。

|

Shimadzu AMI by Region Q1 FY21

|

|