Biotage Reports Strong Sales in China and the Europe & EMEA Region

|

Rev. (M) |

Chg. | |

|---|---|---|

|

Total Company |

SEK 262.6 |

-7.1% |

|

Systems |

SEK 237.3 |

-7.7% |

|

Service Contracts and Other Services |

SEK 23.6 |

0.1% |

|

Other Sales Revenue |

SEK 1.7 |

-18.1% |

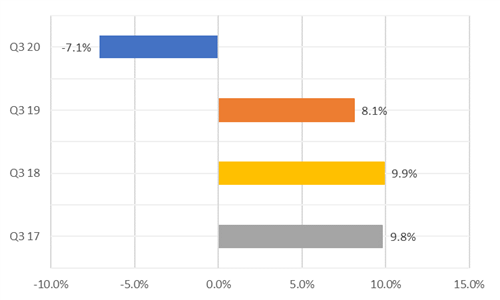

Biotage concluded the third quarter with revenues declining in the high single digits. Organic sales fell 7.1% to SEK 262.6 million ($29.6 million at SEK 8.87 = $1) (see IBO 9/1/20). On a reported basis, systems and aftermarket product sales accounted for 51% and 49% of revenues, respectively.

|

Op. Profit (M) |

Chg. |

Op. Margin |

Chg. (bps) |

|---|---|---|---|

|

SEK 60.7 |

-5.6% |

23.1% |

37 |

Despite reported and organic sales declines for the third quarter, Biotage experienced a 3.3% rise in sales sequentially. The company attributed its third quarter financial performance to cost control and its products meeting demand in COVID-19 vaccine and therapeutic development. However, Biotage still weathered COVID-19-related headwinds, such as business disruptions stemming from global lockdown measures. Additionally, Biotage saw stable demand in the precision medicine market and for non-COVID-19-related product lines.

|

Rev. (M) |

Chg. |

% of Rev. | |

|---|---|---|---|

|

Americas |

SEK 111.8 |

-12.9% |

43% |

|

Europe & EMEA |

SEK 69.6 |

5.9% |

26% |

|

Asia |

SEK 81.2 |

-8.3% |

31% |

On a geographical basis, Biotage reported significant sales growth in Europe & EMEA and specific regions within Asia, especially China. Indeed, the greatest revenue growth for the company came from China. However, China's strong performance could not offset tepid sales in India and Japan due to both regions experiencing business disruptions because of COVID-19.

Europe & EMEA was the only region besides China to report sales growth for Biotage thanks to end-users resuming activities in the area. However, the company noted that sales recovery in Europe & EMEA was proceeding at a slow pace.

|

Rev. (M) |

Chg. | |

|---|---|---|

|

Organic Chemistry |

SEK 141.8 |

7.1% |

|

Analytical Chemistry |

SEK 86.2 |

-8.4% |

|

Scale-Up (formerly Industrial Products) |

SEK 25.5 |

-46.3% |

|

Biomolecules |

SEK 9.1 |

4.5% |

By division, the Organic Chemistry business performed the best due to robust sales for its instrument portfolio in China. In contrast, Biotage's Scale-Up division was the worst performer due to tepid demand from the cannabis market, especially in the Americas.

|

Rev. (M) |

Chg. |

% of Rev. | |

|---|---|---|---|

|

Direct Sales |

SEK 245.3 |

-8.9% |

93.4% |

|

Distributors |

SEK 17.2 |

28.5% |

6.6% |

Biotage did not provide revenue guidance for the fourth quarter or full year. However, the company provided commentary for the remainder of 2020, stating it was in good financial standings to weather any external challenges yet still considered pandemic-related challenges. For example, the company anticipates a longer wait in receiving payment from customers whose own financial position could be impacted by the pandemic. Lastly, Biotage reaffirmed its forecast of an average annual organic sales growth goal of 8% over three years (see IBO 9/11/20).