-

Report details

-

3

Figures

-

35

Tables

-

Chapter One: Executive Summary

-

Molecular Diagnostics in the Spotlight

-

Hundreds of PCR Tests on the Market, U.S. Labs Settle on a Few

-

COVID-19 Market

-

Emerging Trends

-

Automation

-

Molecular Point of Care

-

Next-Generation Sequencing on the Rise

-

LDT Regulation and COVID-19

-

Reimbursement Environment

-

Thermo and Qiagen Merger

-

CRISPR, Sequencing and COVID-19

-

The Global Molecular Diagnostics Market in the Era of COVID-19

-

Chapter Two: COVID-19 Molecular Diagnostic Market Analysis

-

Major IVD Players See Brisk COVID-19 Test Sales

-

North America

-

Europe

-

APAC

-

Latin America

-

Rest-of-World

-

COVID Testing Market Computation Methodology

-

Test Vendors

-

Testing trends, Recommendations, Consensus Taking Shape

-

Chapter Three: Markets for Other Molecular Diagnostic Tests

-

Infectious Diseases

-

Repiratory Diseases: COVID-19 Impact

-

Mycobacteria/Tuberculosis: Market and COVID-19 Impact

-

Hospital-Acquired Infections (HAIs) : Market and COVID-19 Impact

-

Sexually Transmitted Infections: Market and COVID-19 Impact

-

Hepatitis: COVID-19 Impact

-

HIV Market and COVID-19 Impact

-

NAT Blood Screening

-

Molecular Histology and Cytology Diagnostics

-

HPV

-

Eliminating HPV Threat? Lancet Public Health Study

-

COVID-19 Impact

-

Product Developments

-

Markets for Molecular Cancer Diagnostics

-

Cancer Molecular Blood Markers - COVID-19 Impact

-

Molecular Transplant Diagnostics

-

Molecular Inherited Diseases Diagnostics

-

Inherited Diseases - COVID-19 Impact

-

Thrombophilia and Coagulation Markers

-

Non-Invasive Prenatal Testing (NIPT)

-

Inherited Disease Tests

-

Chapter Four: Trends to Watch - Sequencing, CRISPR, Automation

-

Sequencing

-

COVID and NGS

-

NGS and Inherited Disease

-

NGS and Companion Diagnostics

-

Outlook For NGS in Molecular Diagnostics

-

Evolving Informatics Solutions in Clinical Sequencing

-

Sample Preparation and Quality Control

-

Lab Automation and Molecular Diagnostics

-

CRISPR and Molecular Diagnostics

-

Chapter Five: Company Profiles

-

Abbott Diagnostics

-

Company Overview

-

Financial Review

-

COVID-19

-

FDA approval of ALK Break Apart FISH Probe Kit

-

Alinity s System

-

WHO prequalification (PQ) approval of viral load test

-

Agena Bioscience

-

Agendia BV

-

ARUP Laboratories

-

Asuragen Inc.

-

Advanced Cell Diagnostics (Biotechne)

-

Agilent Technologies Inc./Dako

-

Company Overview

-

Financial Review

-

Aidian Oy

-

Altona Diagnostics

-

Amoy Diagnostics

-

Applied Spectral Imaging

-

Becton, Dickinson & Co. (BD)

-

Business Segments

-

Recent Acquisitions

-

Recent Divestitures

-

Leading Position in the Flow Cytometry Market

-

Revenue and Growth

-

Molecular Diagnostics Focus

-

Beijing Genomics Institute (BGI)

-

Complete Genomics

-

Sanger Sequencing

-

Berry Genomics

-

Biocartis

-

Company Overview

-

Financial Review

-

Biodesix

-

Bioneer

-

AccuPower COVID-19 Real-Time RT-PCR Kit

-

Biomeme, Inc

-

bioMérieux

-

Bio-Rad Laboratories, Inc.

-

Key Comment

-

Recent Revenue History

-

inx health

-

CareDx, Inc.

-

AlloMap Tests

-

Products Offered by CareDx

-

CTK Biotech

-

Credo Bioscience

-

Danaher (Cepheid and Leica Biosystems)

-

Life Sciences Business

-

Diagnostics Business

-

Cepheid

-

Leica Biosystems

-

Danaher’s 2019 Performance and 2020 Expectations

-

DiaSorin

-

Eiken Chemical

-

Exact Sciences Corp.

-

Fluidigm Corporation

-

GenMark Diagnostics

-

Genotypic Technology Pvt. Ltd.

-

Greiner Bio-One GmbH

-

Grifols, S. A

-

Molecular Immunohematology and Specialty Testing Products

-

NAT Blood Screening

-

Hologic, Inc.

-

Illumina, Inc.

-

Immucor, Inc.

-

Meridian Bioscience Inc

-

Mesa Biotech, Inc.

-

Molbio Diagnostics Pvt. Ltd.

-

Myriad Genetics, Inc.

-

Company Overview

-

Financial Review

-

NanoString Technologies, Inc.

-

NeuroMoDX

-

PerkinElmer Inc.

-

Oxford Nanopore Technologies Ltd

-

Promega Coproration

-

Prescient Medicine Holdings (AutoGenomics)

-

Qiagen

-

Company Overview

-

Thermo Fisher Purchase

-

QuantuMDx Group

-

uidel Corporation

-

Roche Diagnostics

-

Company Overview

-

COVID-19

-

Financial Review

-

Cobas Liat System - POC

-

Approval for cobas EZH2 Mutation Test

-

June 2020 – partnership with SpeeDX

-

Stratos Genomics

-

HPV

-

PLUS Cytoogy

-

ASPiRATION study

-

Cobas Zika test for blood screening

-

FDA approval of Babesia test

-

FDA 510(k) clearance for cobas TV/MG test

-

Release of NAVIFY Guidelines app

-

EBV and BKV Tests on the cobas 6800/8800 Systems

-

Expanded use of VENTANA PD-L1 (SP142) Assay in triple-negative breast cancer…

-

Rheonix, Inc.

-

Sherlock Biosciences

-

eegene

-

Sekisui Diagnostics LLC

-

T2 Biosystems

-

Thermo Fisher Scientific Inc.

-

Company Overview

-

Transplant Diagnostics

-

qPCR

-

Sequencing

-

Qiagen

-

Vela Diagnostics

-

Veracyte, Inc.

|

Molecular Diagnostics Markets in the COVID-19 Era (Markets for Molecular COVID-19 IVD Tests, Respiratory Tests, Blood Screening, Cancer Markers and Other IVD Tests)

9 Jul 2020

Molecular Diagnostics could be said to be the most important part of in vitro diagnostics. This is especially true in the wake of COVID-19. Kalorama Information has, for many years, estimated the size of and forecasted the growth of the worldwide market for these important in vitro diagnostic tests in all major segments, and does so in this edition as a pandemic has reached developed markets including the United States.

2020 was set to be a year of growth and innovations in molecular diagnostics under any circumstances. New products, higher growth than other in vitro diagnostic categories, continued acceptance of next-generation sequencing methods were driving. Liquid biopsy technologies and the increased use of predictive genetic tests were and still are areas of anticipated revenue growth. The sudden onset of SARS-CoV-2 and the resulting disease COVID-19 put the world’s focus on DNA-based testing in an unexpected way.

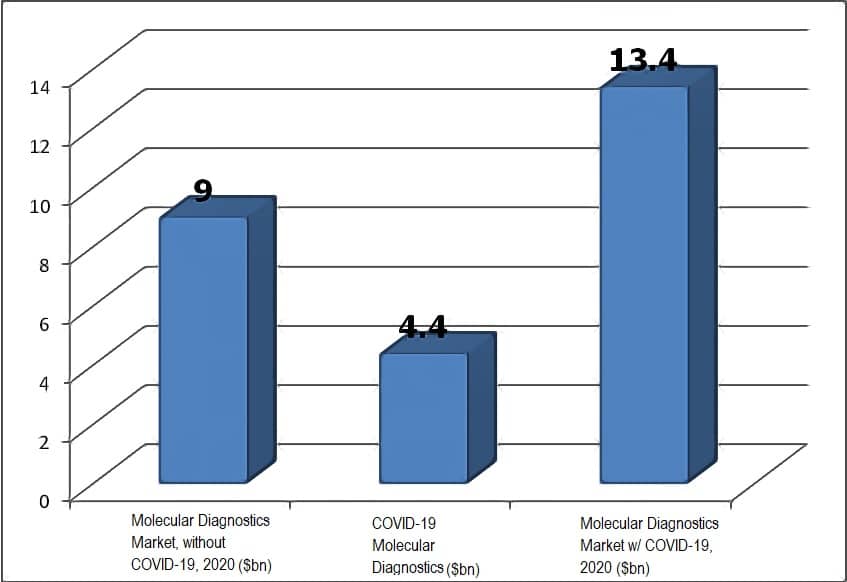

The Size of the Molecular Diagnostic Test Market

As it was MDx segment has been fastest growing segment within the global IVD market. The global market was estimated to be $8,760 million in 2019. Including COVID-19 tests, Kalorama Information now projects that market to be $13.4 billion dollars. A multi-year forecast including COVID-19 cannot be made with accuracy given the unknowns of the virus threat, outside of COVID-19, other test segments are expected to grow to 9,025 in 2025. Major segments that are expected to drive the growth are infectious diseases, cancer, and transplant diagnostics. A detailed analysis of each of these application segments is presented in the respective segment.

Infectious Disease Assays Drive Growth

Infectious disease testing segments are driven by the COVID-19 crisis (not only detection tests but related rule-out respiratory tests and HAIs). The demand will come from advanced markets such as North America and Europe, while blood screening, histology and inherited diseases testing are driven by additions to blood test protocols and emerging markets.

COVID-19 Impact

Kalorama estimates a 4.4 billion dollar market for COVID-19 testing by year’s end. Unique near-patient tests, sample collection methods such as saliva or self-test, NGS and mass spectrometry testing, multiple PCR test targets, improved antibody tests, high throughputs, extraction kit workarounds – these are all examples of areas that innovators can improve. The worldwide demand for COVID tests has materialized rapidly from zero and is on course to become a multi-billion dollar market in 2020.

Will this market continue into future years? Assuming, as estimated in our analysis, cancer tests are able to be completed in a surge of ‘make-up’ healthcare visits and procedures later in the year and into 2021 it presages a strong momentum for growth. It’s worthwhile noting that DNA-based testing technologies already represent nearly a 10 billion-dollar market without COVID-19. While it’s possible COVID-19 tests will be panelized and added to larger menus and may not have the emergency system sales of 2020, its influence should last in other ways. It already has boosted the respiratory and healthcare infection testing market segments.

For More Information: Kalorama Information’s Latest Market Research Study

For more information, Kalorama Information’s report on the worldwide MDx market, Molecular Diagnostics Markets in the COVID-19 Era is available:

This report provides 2020 market sizing and expected growth to 2025 for the following segments:

- COVID-19 Molecular IVD Test Market (Full Year 2020 Projected and Market 2H 2020)

- COVID-19 Molecular IVD Test Market North America

- COVID-19 Molecular IVD Test Market Europe

- COVID-19 Molecular IVD Test Market Asia Pacific

- COVID-19 Molecular IVD Test Market Rest of World

- Infectious Disease Markets, including:

- Sexually Transmitted Diseases

- NAT Blood Testing

- Molecular Histology

- Molecular Cancer Testing

- Molecular Transplantation Testing

- Inherited Disease Testing

There has also been a huge influx of product introductions from small, obscure companies. These have mostly targeted the low end of the price range and often had poor performance, while a small number of high-end automated systems are mostly limited to certain segments of the market, such as independent reference laboratories and centralized hospital laboratories. Low-quality products from fly-by-night companies are the predictable result of the shortages and the relatively basic resources needed to produce mediocre antibody test kits with a low level of quality control. A few major companies are seeing the most test runs, particularly in the United States.

COVID-19 testing has also been a bit of a double-edged sword for labs generally, for in vitro diagnostics and for molecular tests. Boosting volumes in infectious disease have been notably paired with drops due to social distancing measures and hospital surgical postponements. What is the result? Kalorama Information’s report helps to sort out the array of news and reports about the current state of molecular diagnostics, reasonable global estimates for COVID, and the impact of COVID-19 on the rest of molecular testing.

Kalorama covers the global markets. For All Markets, Kalorama Information provides the following:

- Impacts of COVID-19 on Market Segments

- Regional Market Distribution

- Profiles of Top Companies

- Major Companies with COVID-19 Tests

- Other Companies with COVID-19 Tests

- HIV Products on the Market

- Transplantation Products on the Market

- The Increasing Role of Next-Generation Sequencing

- Trends – Lab Automation and Molecular Diagnostics

- Trends – CRISPR

- Trends – Artificial Intelligence

- Company Profiles

Kalorama Information has monitored 2020 secondary sources, trade publications, medical journals, government websites and policy documents, as well as financial statements from vendors to assess the market impact of COVID-19. In addition, Kalorama has been tracking lab volumes with a survey since mid-April, and Kalorama’s U.S. MasterFile product was used to keep track of instrument trends.

Companies Profiled in the Report Include

- Abbott Diagnostics

- Agena Bioscience

- Agendia BV

- ARUP Laboratories

- Asuragen

- Advanced Cell Diagnostics

- Agilent

- Amoy Diagnostics

- Applied Spectral Imaging

- Becton, Dickinson & Co.

- Biocartis

- BGI

- Berry Genomics

- BioMerieux

- Bio-Rad

- Care DX

- Danaher

- Eiken Chemical

- Fluidigm

- GenMark

- Genotypic Technology PVT

- Greiner Bio-One GMBH

- Grifols

- Hologic

- Illumina

- Immucor

- Meridian

- Molbio

- Myriad Genetics

- Nanostring

- Neogenomics

- NeuromoDX

- Perkin Elmer

- Oxford Nanopore

- Promega

- Prescient Medicine

- Qiagen

- Quidel

- Roche

- Thermo

- Vela

- Veracyte

Page Count: 300

Table of Contents

-

Chapter One: Executive Summary

-

Molecular Diagnostics in the Spotlight

-

Hundreds of PCR Tests on the Market, U.S. Labs Settle on a Few

-

COVID-19 Market

-

Emerging Trends

-

Automation

-

Molecular Point of Care

-

Next-Generation Sequencing on the Rise

-

LDT Regulation and COVID-19

-

Reimbursement Environment

-

Thermo and Qiagen Merger

-

CRISPR, Sequencing and COVID-19

-

The Global Molecular Diagnostics Market in the Era of COVID-19

-

Chapter Two: COVID-19 Molecular Diagnostic Market Analysis

-

Major IVD Players See Brisk COVID-19 Test Sales

-

North America

-

Europe

-

APAC

-

Latin America

-

Rest-of-World

-

COVID Testing Market Computation Methodology

-

Test Vendors

-

Testing trends, Recommendations, Consensus Taking Shape

-

Chapter Three: Markets for Other Molecular Diagnostic Tests

-

Infectious Diseases

-

Repiratory Diseases: COVID-19 Impact

-

Mycobacteria/Tuberculosis: Market and COVID-19 Impact

-

Hospital-Acquired Infections (HAIs) : Market and COVID-19 Impact

-

Sexually Transmitted Infections: Market and COVID-19 Impact

-

Hepatitis: COVID-19 Impact

-

HIV Market and COVID-19 Impact

-

NAT Blood Screening

-

Molecular Histology and Cytology Diagnostics

-

HPV

-

Eliminating HPV Threat? Lancet Public Health Study

-

COVID-19 Impact

-

Product Developments

-

Markets for Molecular Cancer Diagnostics

-

Cancer Molecular Blood Markers - COVID-19 Impact

-

Molecular Transplant Diagnostics

-

Molecular Inherited Diseases Diagnostics

-

Inherited Diseases - COVID-19 Impact

-

Thrombophilia and Coagulation Markers

-

Non-Invasive Prenatal Testing (NIPT)

-

Inherited Disease Tests

-

Chapter Four: Trends to Watch - Sequencing, CRISPR, Automation

-

Sequencing

-

COVID and NGS

-

NGS and Inherited Disease

-

NGS and Companion Diagnostics

-

Outlook For NGS in Molecular Diagnostics

-

Evolving Informatics Solutions in Clinical Sequencing

-

Sample Preparation and Quality Control

-

Lab Automation and Molecular Diagnostics

-

CRISPR and Molecular Diagnostics

-

Chapter Five: Company Profiles

-

Abbott Diagnostics

-

Company Overview

-

Financial Review

-

COVID-19

-

FDA approval of ALK Break Apart FISH Probe Kit

-

Alinity s System

-

WHO prequalification (PQ) approval of viral load test

-

Agena Bioscience

-

Agendia BV

-

ARUP Laboratories

-

Asuragen Inc.

-

Advanced Cell Diagnostics (Biotechne)

-

Agilent Technologies Inc./Dako

-

Company Overview

-

Financial Review

-

Aidian Oy

-

Altona Diagnostics

-

Amoy Diagnostics

-

Applied Spectral Imaging

-

Becton, Dickinson & Co. (BD)

-

Business Segments

-

Recent Acquisitions

-

Recent Divestitures

-

Leading Position in the Flow Cytometry Market

-

Revenue and Growth

-

Molecular Diagnostics Focus

-

Beijing Genomics Institute (BGI)

-

Complete Genomics

-

Sanger Sequencing

-

Berry Genomics

-

Biocartis

-

Company Overview

-

Financial Review

-

Biodesix

-

Bioneer

-

AccuPower COVID-19 Real-Time RT-PCR Kit

-

Biomeme, Inc

-

bioMérieux

-

Bio-Rad Laboratories, Inc.

-

Key Comment

-

Recent Revenue History

-

inx health

-

CareDx, Inc.

-

AlloMap Tests

-

Products Offered by CareDx

-

CTK Biotech

-

Credo Bioscience

-

Danaher (Cepheid and Leica Biosystems)

-

Life Sciences Business

-

Diagnostics Business

-

Cepheid

-

Leica Biosystems

-

Danaher’s 2019 Performance and 2020 Expectations

-

DiaSorin

-

Eiken Chemical

-

Exact Sciences Corp.

-

Fluidigm Corporation

-

GenMark Diagnostics

-

Genotypic Technology Pvt. Ltd.

-

Greiner Bio-One GmbH

-

Grifols, S. A

-

Molecular Immunohematology and Specialty Testing Products

-

NAT Blood Screening

-

Hologic, Inc.

-

Illumina, Inc.

-

Immucor, Inc.

-

Meridian Bioscience Inc

-

Mesa Biotech, Inc.

-

Molbio Diagnostics Pvt. Ltd.

-

Myriad Genetics, Inc.

-

Company Overview

-

Financial Review

-

NanoString Technologies, Inc.

-

NeuroMoDX

-

PerkinElmer Inc.

-

Oxford Nanopore Technologies Ltd

-

Promega Coproration

-

Prescient Medicine Holdings (AutoGenomics)

-

Qiagen

-

Company Overview

-

Thermo Fisher Purchase

-

QuantuMDx Group

-

uidel Corporation

-

Roche Diagnostics

-

Company Overview

-

COVID-19

-

Financial Review

-

Cobas Liat System - POC

-

Approval for cobas EZH2 Mutation Test

-

June 2020 – partnership with SpeeDX

-

Stratos Genomics

-

HPV

-

PLUS Cytoogy

-

ASPiRATION study

-

Cobas Zika test for blood screening

-

FDA approval of Babesia test

-

FDA 510(k) clearance for cobas TV/MG test

-

Release of NAVIFY Guidelines app

-

EBV and BKV Tests on the cobas 6800/8800 Systems

-

Expanded use of VENTANA PD-L1 (SP142) Assay in triple-negative breast cancer (TNBC)

-

Rheonix, Inc.

-

Sherlock Biosciences

-

eegene

-

Sekisui Diagnostics LLC

-

T2 Biosystems

-

Thermo Fisher Scientific Inc.

-

Company Overview

-

Transplant Diagnostics

-

qPCR

-

Sequencing

-

Qiagen

-

Vela Diagnostics

-

Veracyte, Inc.

|

More information about this product

Other Users Also Viewed

26 Aug 2020

What is the Size of IVD Market Segments? Who’s Winning? Who’s Merged? Who’s Launched Game-Changing Products?

One book definitively answers these questions, from a publisher that is focused on in vitro diagnostics. Now in its 13th edition, this…

|